- 605-305-3099

A Century-Long Investment Opportunity

“If you wouldn’t think about holding a stock for ten years, then don’t think about it for ten minutes.” (Warren Buffet)

Songs for Centuries Inc. offers a unique, forward-thinking investment model designed for true long-term investors who understand the power of patience and strategic growth. With exclusive 100-year rights to a catalog of of over hundreds of creative works of Mr. Songwriter across 181 countries, this investment opportunity is built on a solid foundation of intellectual property, sustained revenue potential, and legal protections that ensure its longevity.

Key Advantages for Long-Term Investors:

✅ 10-Year Lock-Up Period – In alignment with Warren Buffett’s investment philosophy, investors must hold their shares for a minimum of 10 years, ensuring long-term value creation.

✅ 100% Tax-Free Gains – Investors who maintain their shares for at least 10 years benefit from zero capital gains tax until 2047, leveraging Opportunity Zone Stock (OPP Zone Stock) advantages.

✅ Legacy-Driven Growth – Unlike short-term speculative investments, Songs for Centuries is structured as a true generational asset, providing sustained financial benefits for decades.

This is an opportunity to be part of a century-long enterprise designed to stand the test of time—built for visionaries who see beyond the next quarter and into the next century.

E.E.L.M.R. Strategy for Generational Wealth

“Songs for Centuries is designed to create long-term value and sustain earnings for generations.”

At Songs for Centuries Inc., we are committed to building lasting value and sustaining earnings for generations through our proprietary E.E.L.M.R. Strategy—the Exclusive & Effective Exploitation of Lyrics, Melodies, and Master Recordings.

Our 100-year exclusive rights to the works of Mr. Songwriter, protected in 181 countries, position us as a long-term market leader in music intellectual property monetization. By strategically leveraging this catalog, we ensure consistent revenue growth across multiple high-value channels.

How E.E.L.M.R. Drives Investor Returns:

🎵 Streaming & AI-Based Licensing – Maximizing digital revenue through streaming platforms and AI-driven licensing agreements that adapt to emerging technologies.

💿 Music Catalog Monetization – Expanding catalog value through global licensing, re-releases, and new distribution models.

👕 Merchandising & Brand Partnerships – Strengthening brand equity with exclusive merchandising lines, fashion collaborations, and direct-to-fan engagement.

🎬 Film, TV, & Commercial Sync Deals – Securing premium placements in film, television, advertisements, and video games, increasing exposure and long-term royalty streams.

Why Invest?

With the E.E.L.M.R. Strategy, Songs for Centuries is not just creating music—we are creating generational wealth through a diversified, future-proof model. This is an opportunity to be part of an investment designed to grow and compound over time, ensuring sustainable financial success for decades to come.

🚀 Invest in the future of music. Invest in Songs for Centuries.

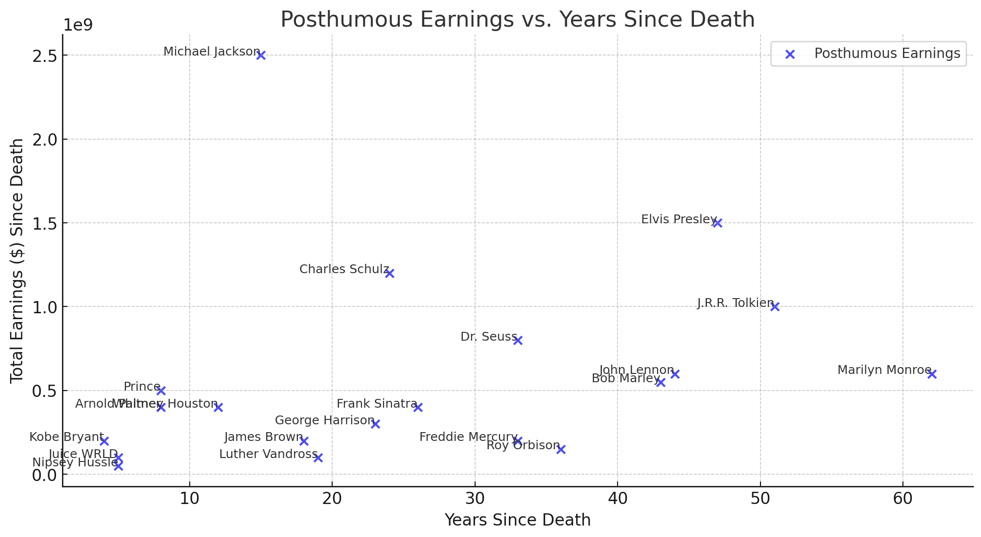

The Billion-Dollar Proof: Copyrights & Image Rights as Generational Wealth

History has proven that owning creative works and image rights is the foundation for long-term financial success—even beyond an artist’s lifetime. The estates of the highest-earning deceased celebrities continue to generate hundreds of millions to billions of dollars through music royalties, merchandising, licensing, and media adaptations.

Key Takeaways from the Billion-Dollar Estates:

✅ Ownership Creates Wealth – Every high-earning estate maintained control over copyrights, music catalogs, books, or image rights, allowing their legacy to continue generating revenue.

✅ Diverse Revenue Streams – From streaming and film syncs (Michael Jackson, Whitney Houston) to brand licensing and merchandising (Marilyn Monroe, Bob Marley), these estates maximize value through multiple platforms.

✅ Generational Earnings – Estates like J.R.R. Tolkien ($1B+), Charles Schulz ($1.2B), and Elvis Presley ($1.5B) continue earning decades after their passing, proving that intellectual property outlives the creator.

✅ Music Catalogs Hold Long-Term Value – The Beatles, Prince, James Brown, and John Lennon continue to earn millions annually, driven by streaming, licensing, and estate-controlled deals.

The Investment Lesson:

Songs for Centuries Inc. follows this proven generational wealth model by maintaining 100-year exclusive rights to Mr. Songwriter’s catalog in 181 countries. By controlling copyrights, licensing, and global distribution, we ensure sustained earnings not just for today—but for the next century.

📢 Invest in a Legacy. Invest in Songs for Centuries. 🚀

Celebrity | Died | Years Since Death | Earnings Since Death | Revenue Sources |

Marilyn Monroe | 1962 | 63 | $800M | Image licensing, endorsements, fashion, films |

J.R.R. Tolkien | 1973 | 52 | $1.0B | Book sales, movie rights, TV licensing, merchandising |

Elvis Presley | 1977 | 48 | $1.5B | Graceland, licensing, merchandise |

John Lennon | 1980 | 45 | $600M | Music sales, licensing, Beatles catalog |

Bob Marley | 1981 | 44 | $550M | Merchandising, licensing, streaming |

Dr. Seuss | 1991 | 33 | $800M | Book sales, licensing, adaptations |

Charles Schulz | 2000 | 24 | $1.2B | Peanuts franchise, TV specials, licensing |

Michael Jackson | 2009 | 15 | $2.5B | Music catalog, licensing, streaming |

Whitney Houston | 2012 | 12 | $250M | Music catalog, licensing, film sync |

Prince | 2016 | 8 | $300M | Streaming, estate licensing, merchandise |

James Brown | 2006 | 18 | $100M | Music royalties, estate licensing, film sync |

These estates continue earning millions annually, proving that ownership of copyrights and licensing rights leads to generational wealth.

Why Songs for Centuries is a Legacy Investment

Songs for Centuries Inc. offers a legacy-driven investment opportunity unlike any other in the music industry. By combining exclusive intellectual property rights, tax-advantaged stock, and fan-driven ownership, we have created a sustainable model for long-term wealth generation.

✅ 100-Year Monopoly on Intellectual Property

With exclusive rights to Mr. Songwriter’s catalog for the next century, our music assets are protected for long-term value appreciation and revenue growth.

✅ Opportunity Zone Stock (OPP Zone Stock) – 100% Tax-Free Gains

Investors who hold for 10+ years pay zero capital gains tax until 2047, maximizing wealth accumulation without tax burdens.

✅ Exclusive Ownership Model – Investors Share in the Success

Unlike major music corporations where only insiders profit, our structure allows direct investor participation in the long-term success of the catalog.

✅ FAN-holders: Turning Fans into Shareholders

Fans can own equity in Mr. Songwriter’s legacy, creating an investment model where music lovers benefit financially while fostering deep engagement and loyalty.

✅ Proven Revenue Strategy: E.E.L.M.R. (Lyrics, Melodies, Masters)

Our structured approach to monetizing copyrights across streaming, licensing, merchandising, and media ensures sustained, diversified revenue.

✅ Technology-Driven Profitability

We integrate streaming, AI licensing, blockchain, and global digital distribution to future-proof revenue streams beyond traditional music industry models.

Invest in Music: Private Placement Memorandum

Welcome to the dedicated information page for the Confidential Final Private Placement Memorandum (PPM) for “Songs for Centuries.” This PPM, v1.22.24 provides detailed insights into our exclusive investment opportunity, backed by a unique portfolio of musical assets.

Legal Disclaimer

This PPM is confidential and intended solely for the use of accredited investors. It is not a public offer and is not to be distributed or disclosed to non-qualified parties. The securities mentioned herein have not been registered under the United States Securities Act of 1933, as amended, or any state securities laws.

Eligibility Criteria

To request a copy of the PPM, you must qualify as an accredited investor. This section outlines the criteria that define an accredited investor as per the latest SEC amendments:

- Financial Criteria: Individuals with a net worth over $1 million (excluding the value of their primary residence), or an annual income exceeding $200,000 (or $300,000 jointly with a spouse) in the last two years, with a reasonable expectation of the same or higher income in the current year.

- Professional Credentials: Individuals holding certain professional certifications, designations, or credentials from an accredited educational institution, as recognized by the SEC.

- Knowledgeable Employees: Certain employees of a private fund (such as executive officers, directors, trustees, general partners, advisory board members) who have sufficient knowledge and experience in financial matters.

- Registered Investment Advisers and Entities: Investment advisers registered with the SEC or states, and certain entities like family offices with assets over $5 million.

- Joint Investments: The SEC recognizes “spousal equivalents” for the purpose of pooling finances to qualify as accredited investors.

- Verification of Accredited Investor Status under Rule 506(c)

Under SEC Regulation D, Rule 506(c), Songs for Centuries Inc. is required to take reasonable steps to verify the accredited investor status of potential investors, which includes the review of financial documentation and obtaining third-party confirmation.

- Responsibility of Investors

Investors are expected to provide accurate and complete information to facilitate the verification process. Misrepresentation can have legal implications and affect the validity of the investment.

- Legal and Compliance Considerations

Songs for Centuries Inc. adheres to all SEC regulations and legal requirements in its investment offerings, ensuring compliance with the verification requirements under Rule 506(c).

- Reference to Expanded Definition of Accredited Investor

For a comprehensive understanding of the expanded definition of an accredited investor, investors are encouraged to refer to the official documentation published in the Federal Register. 64234 Federal Register / Vol. 85, No. 197 / Friday, October 9, 2020 / Rules and Regulations. The detailed definition can be found at the following link: Accredited Investor Definition, and legal counsel as well as tax advisors.

https://www.federalregister.gov/documents/2020/10/09/2020-19189/accredited-investor-definition

Request Process

Interested parties who meet the eligibility criteria may request a copy of the PPM by:

- Completing the Form In Word Or PDF

- Providing proof of accredited investor status.

- Agreeing to confidentiality and non-disclosure terms.

- Fax the Form to (605) 223-6778 or email to investors at songs for centuries dot com.

CUSIP Number & EDGAR Filing

The PPM for “Songs for Centuries” is identified by CUSIP number 83546M207

The associated EDGAR filing can be accessed CIK #0001980357

Contact Information

For further information or specific inquiries, please contact us at 605-305-3099 or email investors at songs for centuries dot com.

Security and Confidentiality

We are committed to the highest standards of data security and confidentiality. All information shared from you and handled with utmost discretion.

Regulatory Compliance and Governance

We adhere strictly to SEC regulations and other legal requirements to ensure transparent and responsible governance of our investment products.

Accessibility

This webpage is designed for accessibility and ease of use across various devices. If you encounter any issues or require assistance, please contact us.

Updates and Amendments

We will communicate any updates or amendments to the PPM through this portal and direct communication to interested parties.

© 2024 Songs for Centuries Inc.